Wealth Management

Investment Advisory Built on Trust

At CUBIC Advisors, clients come first. We help individuals and families build, preserve, and manage wealth so they can pursue their financial goals.

We help people, businesses, and institutions build, preserve, and manage wealth so they can pursue their financial goals.

Wealth ManagementFiduciary Commitment

We are ethically and legally bound to act in your best interest at all times.

Personalized Service

Every client receives a customized investment strategy tailored to their unique goals.

Transparent Approach

Clear communication and full transparency in fees, strategies, and performance.

Proven Results

A track record of helping clients achieve their long-term financial goals.

Assets Under Management

$49.9M

Years of Experience

25+

Client Satisfaction

100%

* As of December 31, 2024

technology-convergence

Elon Musk's Master Plan: How Tesla, SpaceX, and xAI Are Converging

In a revealing two-hour conversation with Indian entrepreneur Nikhil Kamath, Elon Musk pulled back the curtain on something most people have missed: his companies aren't separate businesses—they're pieces of a single, audacious puzzle.

market

Gold's Historic Rally in 2025: Four Forces Driving the Run to $4,200

A convergence of domestic and global forces are powering gold's record rise.

retirement

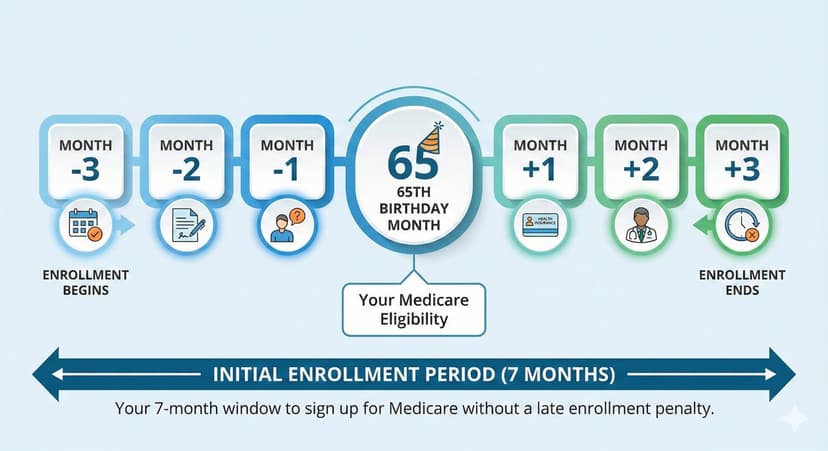

The Medicare Deadline Nobody Tells You About: What to Do Before You Turn 65

Turning 65 triggers a critical seven-month enrollment window for Medicare, and missing it can result in lifetime penalties of approximately 10% per year on your Part B premium. The 2025 Inflation Reduction Act caps prescription drug costs at $2,000 annually and eliminates the coverage gap, making timely enrollment more valuable than ever.

Sign up to get CUBIC Advisors' insights delivered to your inbox.

Ready to Start Your Investment Journey?

Schedule a complimentary consultation to discuss your financial goals and learn how CUBIC Advisors can help you achieve them.